Fund Launches

NT BDC Launch Trends Highlight Two Ways the Market Has Changed

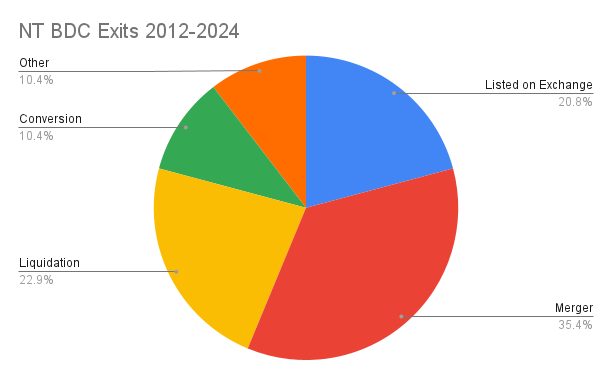

In the mid 2010s, it looked like the entire non-traded BDC industry was on the verge of extinction. Several major funds closed, and overall assets declined steadily between 2017 and 2020. Yet beneath the surface, the beginnings of a new boom boom were already building. The new boom in the NT BDC market is part […]

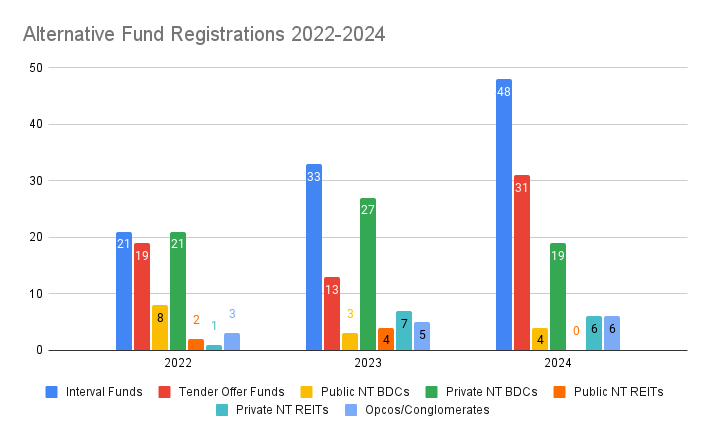

Alternative Fund Registrations Surge in 2024

This chart shows the number of new alternative investment funds that filed registration statements with the SEC over the past three years. Several trends jump out from this chart. First, interval funds are becoming the structure of choice for fund managers that want to bring alternative strategies to a broader audience. Similarly, “traditional” asset managers […]

NT BDC Sector Insights: Trends, Growth, and Market Leaders (May 2024)

As of the end of Q1 in 2024, total assets in NT BDCs reached $202.6 billion, up 36% from the same time last year. There are currently 103 NT BDCs in the markets, including 21 public and 82 private. Total net assets in NT BDCs, totalled $112 billion as of the end of 2024Q1. By […]

Asset Allocation

Policy Changes to Drive Further Growth and Innovation in Alternative Investments

For decades, retail investors watched from the sidelines as institutions and ultra-high-net-worth families tapped into the higher return potential of private equity, private credit, and real assets. Barriers like strict allocation caps, accreditation requirements, and fiduciary caution kept these markets largely out of reach. That wall is finally coming down. In 2025, two major policy […]

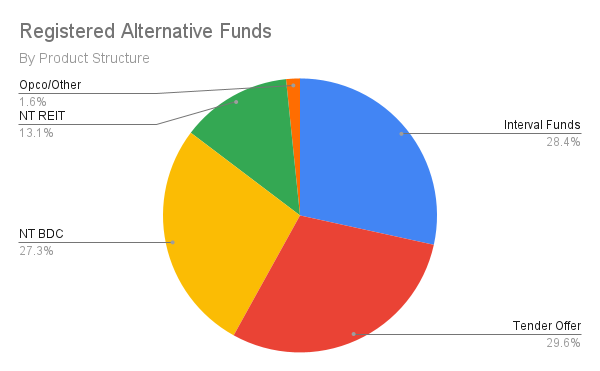

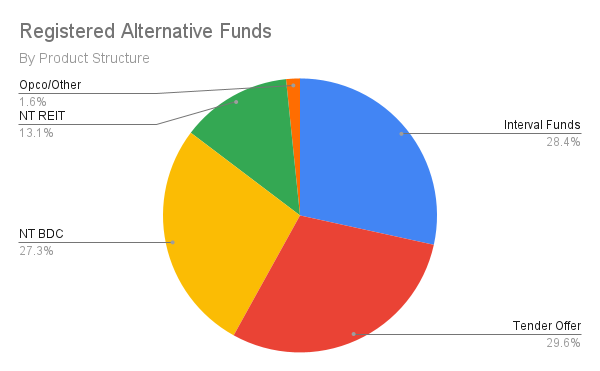

A Snapshot of the Registered Alternative Funds Market

Alternative.Investments and Interval Fund Tracker together cover all publicly registered non-traded alternative investment funds that file with the SEC. This universe includes more than 420 funds, and more than $410 billion in net assets(excluding the impact of leverage). The registered alts market includes a broad range of product structures including: The registered alts market also […]

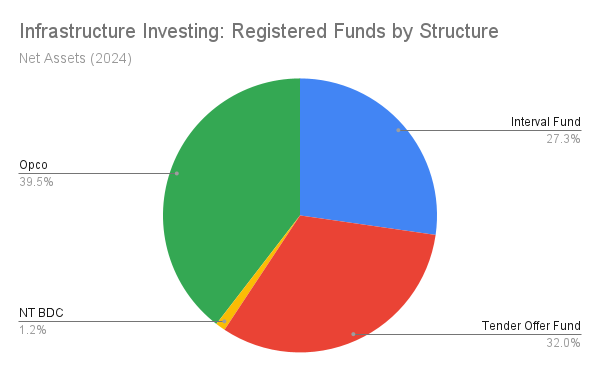

The Rise of Infrastructure Funds

Infrastructure is a component of real asset investing that focuses on the distribution of goods, people, and resources. Examples of economic infrastructure assets include ports, airports, tollroads, bridges, energy distribution networks, and data centers. Examples of social infrastructure include education facilities, hospitals, and government buildings. Infrastructure assets have several highly favorable characteristics: According to the […]

Tender Offers

Alternative Liquidity Capital Launches Tender Offer for Shares of the Wildermuth Fund

Alternative Liquidity Capital has launched a new unsolicited tender offer for shares of the Wildermuth Fund, a closed end interval fund. Alternative Liquidity is offering to purchase up to 238,000 Class I Shares at a price of $2.50 per share. The fund’s estimated NAV is $10.00 per share as of August 14, 2023. In June […]

Liquidity Opportunity for Skybridge Multi-Adviser Hedge Fund Portfolios

Alternative Liquidity Index, LP, a Delaware limited partnership (the “Purchaser”), today announced an offer to purchase up to 16,000 Multi-Strategy Series G Shares (the “Shares”), of Skybridge Multi-Adviser Hedge Fund Portfolios LLC (the “Fund”). The Fund’s recent repurchase offer was oversubscribed, and this Offer provides an opportunity for investors to sell their entire investment for […]

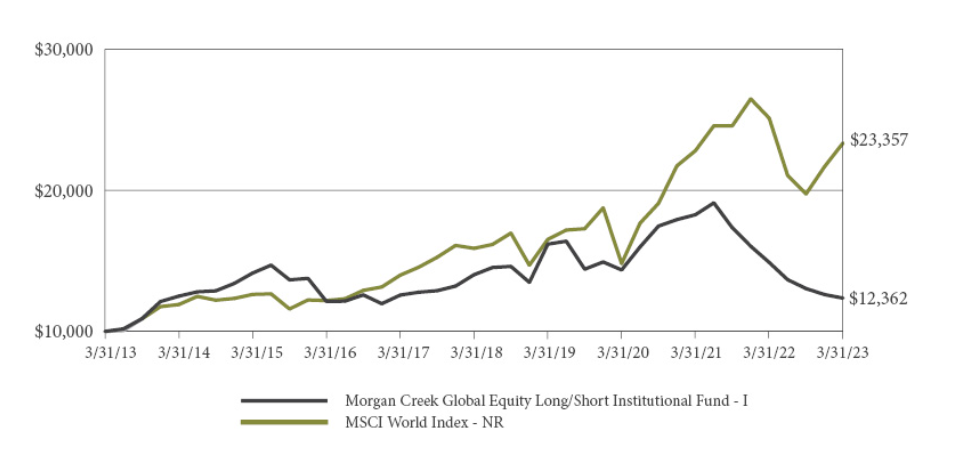

Morgan Creek Global Equity Long/Short Fund Liquidation

Morgan Creek Global Equity Long/Short Fund launched in 2011. It is an unlisted closed end fund(tender offer fund) that invests in a diversified portfolio of hedge funds and other private funds, mainly following long/short equity strategies, including both US and foreign stocks. They invested in many of the largest brand name hedge fund franchises including […]

Alternative Asset Managers

Retail Access to Private Markets: What the SEC’s IAC Report Means for Registered Funds and Asset Managers

In September 2025, the SEC’s Investor Advisory Committee (IAC) released its recommendations on “Retail Investor Access to Private Market Assets.” While not binding, the report reflects growing regulatory momentum toward expanding ordinary investors’ ability to participate in private equity, private credit, venture capital, and real estate. For asset managers, the message is clear: the democratization […]

A Snapshot of the Registered Alternative Funds Market

Alternative.Investments and Interval Fund Tracker together cover all publicly registered non-traded alternative investment funds that file with the SEC. This universe includes more than 420 funds, and more than $410 billion in net assets(excluding the impact of leverage). The registered alts market includes a broad range of product structures including: The registered alts market also […]

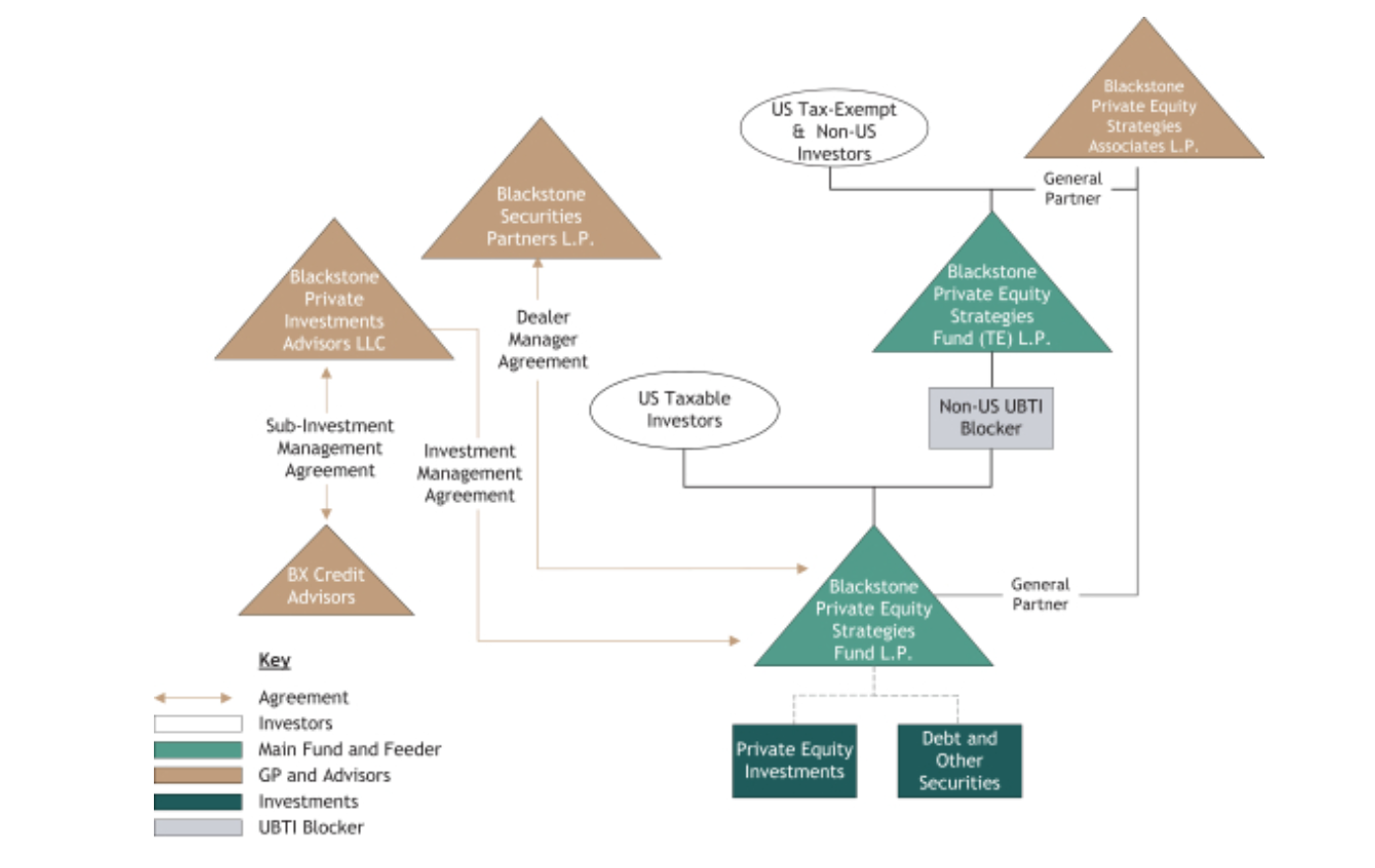

Blackstone Private Equity Strategies Fund Revives Launch Plans

Redemption overload at Blackstone’s flagship non-traded REIT cast a pall over the whole retail alternative sector for several months. Blackstone had to delay the launch of Blackstone Private Equity Strategies Fund(BXPE), a publicly registered vehicle designed to bring traditional private equity to a wider audience of investors. Yet the launch plans are back on now, […]