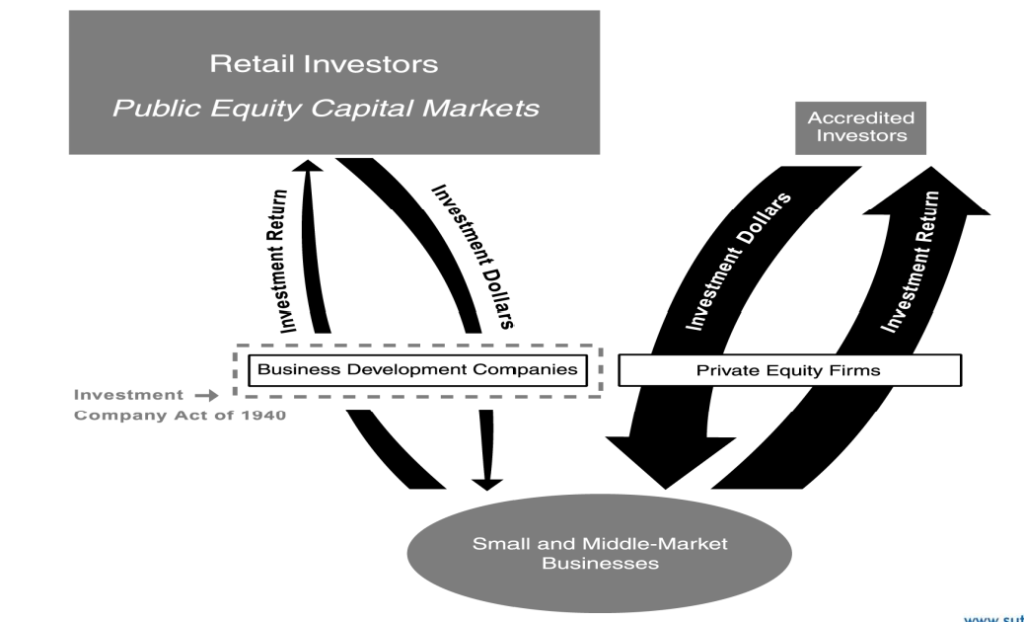

A business development company is a special type of closed end fund that invests in the debt and equity of small and medium sized businesses in the United States. BDCs provide an opportunity for investors to access private credit and equity investments normally only available to institutions. At the same time, BDCS play an important role in capital formation, providing debt and equity financing to small and medium sized firms which would otherwise have limited access to the capital markets.

BDCs can both debt and equity. Most BDCs specialize in one or the other. The vast majority of BDCs in the market today focus on the credit markets. Typically credit BDCs have a primary objective of providing steady income, although they might also earn capital gains. Equity BDCs, in contrast, usually focus on capital appreciation.

Congress created Business Development Companies in the Small Business Investment Incentive Act of 1980. This law amended the Investment Company Act of 1940. Prior to the creation of the BDC structure, private equity and venture capital firms faced legal restrictions that limited their ability to invest in small, growing businesses, and still sell securities. The stated objective of the new rule was to allow capital to flow from the public markets to private businesses through the creation of a new investment vehicle. It took a few decades for the structure to catch on. In fact by the year 2000, only three NT BDCs were active in the market. However, in the last two decades, the structure has grown substantially.

This diagram summarizes how BDCs work:

BDC Strategies

BDCS can invest at any level of the capital structure. There are many different BDC sub strategies focusing on different areas of the capital structure, and different methods of sourcing assets.

Equity is the riskiest part of the capital structure, but also provides the greatest upside. Unsecured loans will have a higher yield but offer minimal downside in the event of bankruptcy or restructuring. Senior secured loans, in contrast are secured by assets of the company. Within the different types of securities there can be a wide range of terms. For example, some loans have restrictive covenants to protect investors, while others are “covenant lite”

Some BDCs focus on directly originating loans. In this case they negotiate terms with portfolio companies and possibly also charge origination fees. This strategy has the advantage of providing truly unique portfolio exposure, and requires additional manager expertise. However, it can also be riskier, because if a portfolio company fails, a directly originated loan may be harder to sell or restructure. Other BDCs buy leveraged loans on the secondary market. This strategy makes the portfolio easier to analyze, but also has the disadvantage of providing less unique exposure.

Understanding the BDCs strategy and unique value add is an essential part of the due diligence process.

BDC Structures

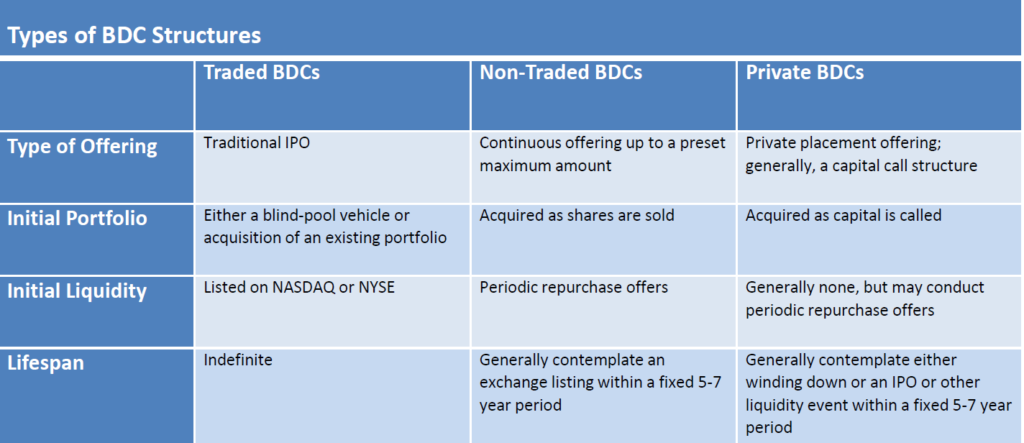

We can divide BDCS into three subcategories: publicly traded BDCs, public non-traded BDCs, and private BDCs.

Traded BDCS are listed on a major stock exchange. In contrast, non-traded and private BDCS are offered on a continuous basis according to a prospectus or private placement memorandum(PPM).

The following diagram summarizes the similarities and differences between different types of BDCs.

Liquidity

The key difference between the different BDC categories is liquidity. You can buy and sell traded BDCs relatively quickly at any online broker. In contrast, secondary trading is limited for non-traded BDCs, whether public or private. Non-traded BDCs typically have share repurchase plans under which they regularly provide limited liquidity to investors. However, the repurchase program might be oversubscribed, and BDC’s board can choose to suspend it , so investors in non-traded BDCS should always take a long term perspective.

Investors holding an NT BDC that suspends their repurchase program can sell their fund on the secondary market. Alternative Liquidity Capital offers quick, easy liquidity for NT BDC shareholders looking to exit.

There are tradeoffs that come with liquidity. The quoted price for a traded BDC can fluctuate widely, and may be more correlated to the broader stock market than real estate. Consequently, it may not provide the same level of portfolio diversification that is available through non-traded BDCs.

Public and Private BDC Offerings

Another distinguishing characteristic of private BDCs is the way they conduct their offerings. Traded BDCs will do a traditional IPO on a stock exchange. Public non-traded BDCs conduct a continuous public offering up to a preset maximum amount. Private BDCS offer shares via a private placement offering. Most private BDCs also use a capital call structure.

Public non-traded BDCs need to file a registration on Form N-2 when they first launch. The Form N-2 will contain detailed information on the fund’s strategy and structure. Private BDCs only need to file a registration on Form 10. Whether traded or nontraded, public or private, all BDCs need to make detailed financial information available on a quarterly basis by filing Form’s 10-Q and 10-K with the SEC.

For more information on BDC filing requirements see this presentation from the 2018 BDC Roundtable.

Transparency

Private BDCs and Public NT BDCs aren’t listed on any exchanges, but they still must still be registered with the SEC, and are still required to file quarterly and annual reports. This information can all be found on the SEC’s EDGAR database. Although it can be difficult to dig through the massive amount of information in SEC Filings, you can Click Here to access key information in an easy to analyze format.

Historically it has been difficult for investors to find unbiased information on non-traded BDCs, but there have been major improvements in recent years. Alternative.Investments also provides detailed data on performance, fees and more. For Broker Dealers and RIAs, there are a variety of due diligence firms that provide in depth coverage of non-traded BDCs, as well as other alternative investments.

BDC Tax Advantages and structure requirements

By definition, BDCs must also invest at least 70% of its assets in private or public US firms with market capitalization of less than $250 million. Additionally, they may be required to provide managerial assistance to portfolio companies. There are many nuances to the requirements of the BDC structure.

To qualify as a BDC, a company must also register under the 1940 Act. This provides many protections for investors. It also leads to certain restrictions on the type of companies they can invest in. For example, all securities must be of an “eligible portfolio” company as defined in the 1940 act. Meeting the definition of “eligible portfolio company” requires additional legal analysis. BDCS also have limitations on the amount of leverage they can use. They are required to maintain asset coverage level of 200% of debt. Congress recently made changes that increase the amount of leverage BDCs are allowed to use. There are important legal nuances on how leverage is defined and measured. Check out this analysis from a law firm.

Most non-traded BDCs are structured as Regulated Investment Companies, in order to provide tax-advantaged, pass-through treatment of ordinary income and long-term capital gains directly to stockholders. If they are structured as RIC, the BDC avoids corporate taxations, but they must distribute at least 90% of their protits to shareholders. This requirement is similar to that of REITs.

Where to learn more about NT-BDCS

5 Benefits of non-traded BDCS

Recent NT BDC Launches (need to write)

NT BDC Asset Growth

Other NT BDC Resources

What are Non-traded Business Development Companies (BDCs)