A 1031 exchange is when an investor swaps one investment property for another in order to defer capital gains taxes. If an investor has held a property for a long time, they would likely face a massive tax bill upon selling it. However with a 1031 exchange, they are able to defer capital gains taxes. In fact by repeatedly doing 1031 exchanges, an investor can practically defer capital gains taxes indefinitely. The term 1031 Exchange gets its name from Section 1031 of the Internal Revenue Code. See Also : IRS Fact Sheet on 1031 Exchanges

In a recent survey, Cerulli found that 31% of financial advisors reported using 1031 Exchanges in 2022, accounting for 21% of their overall alternative asset allocation.

Key Requirements of a 1031 Exchange

There are many strict requirements to completing a 1031 exchange. You must exchange into another “like kind” investment property. “Like kind” generally means assets of a similar nature, although they can differ in grade or quality. The replacement property must be of equal or greater value than the property that you sold.

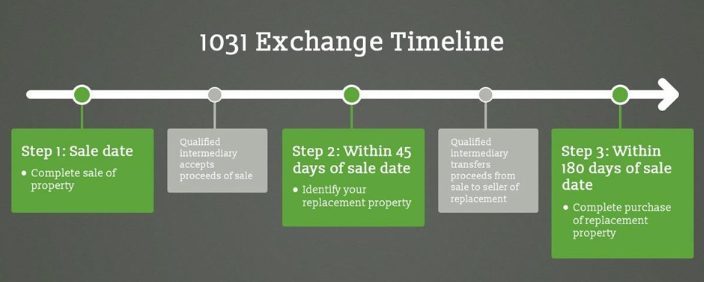

There are also strict time limits on when you can identify and close on the replacement property You must identify a replacement property within 45 days of the sale. An investor doesn’t necessarily need to decide right away. They can actually identify several different potential properties, using one of these rules. Under the three property rule, you can identify thee potential properties to buy. Alternatively you can use the 200% rule, which allows you to identify unlimited potential replacement properties, as long as the cumulative value doesn’t exceed 200% of the property you sold. Under the 95% rule, you can identify as many properties as you like as long as you acquire 95% of them by value.

Regardless of how many potential properties you identify, you must complete the purchase of the replacement property within 180 days. An investor completing a 1031 exchange must strictly follow these timelines in order to receive the tax benefits.

CWS Capital has this diagram to explain the timeline for a 1031 exchange:

A couple other requirements to note:

- You must invest all process from the sale(any difference s referred to as “boot”)

- Even though there is a delay between the sale of the first property and the purchase of the replacement property, you can’t take possession of the funds without losing 1031 exchange. To solve this problem, you need to identify a qualified intermediary to hold the funds.

The rules around 1031 exchanges can be complex for non-specialists, and getting the procedural details right is essential, so most investors should consider getting help from a financial advisor and/or an attorney.

Syndicated 1031 Exchanges

Another option you have is to replace your investment real estate with a syndicated real estate program. A real estate syndication takes capital from a group of investors to purchase a single property, or a portfolio of properties. With a syndicated 1031 exchange, you exchange your property for an interest in the syndicated fund.

Broadly speaking there are two main types of real estate syndications: Delaware Statutory Trusts, and Tenant In Common(TICs). With a DST, the trust owns 100% of the fee interest in the property, and there is no limit on the number of investors. Under this setup it is easier to get financing for the property, since there is only one legal property. In contrast with TICs, the property is effectively subdivided. With a TIC syndication there can be no more than 35 investors.

See also: Benefits of the Delaware Statutory Trust Vs Tenant Inc Common Investment.

Mountain Dell Consulting reported that syndicated exchanges raised $7.4 billion in 2021 via 265 programs, more than double the $3.2 billion raised in 2020.