Five Steps to Implementing an ESG Strategy

Environmental, Social and Governance (ESG) investing is on the rise. The Chartered Alternative Investment Analyst Program has made ESG topics an important part of the analyst curriculum. This reflects the fact that understanding ESG issues is essential for alternative investment professionals. This article outlines five steps firms can take to create an ESG strategy from scratch.

Asset managers and investors need to have an ESG strategy. Approximately 76% of institutional investors incorporate ESG into their investment decisions. ESG can lead to increased risk adjusted returns, redacted reputational risks. Additionally ESG can help an investment organization address stakeholder concerns. Moreover, ESG, done right, is just plain good for the planet.

Many investors don’t know where to start. Fortunately this article outlines five simple steps asset managers can take to implement ESG into their investment process.

Here are the five steps investors can follow.

Articulate Mission and Values

The goal of the first step is to clarify and build consensus regarding the mission and values of the program, expressed in part as the identification of key areas to target

Create Impact Themes or Theses

This step starts at the broadest levels, such as environmental, social, governance or other issues, but then it drills down to specific themes or issues. These themes might be broad categories of issues that share common features, or might be extremely diversified. It all depends on the mission and values of the organization implementing an ESG program. Materiality in this step can be used to identify priorities between missions. This help form the social target of the program. Some common steps in this process include incorporating targets of social programs into an investment policy.

Develop Impact Investment Policy

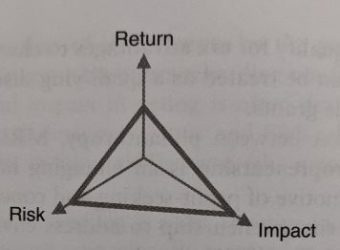

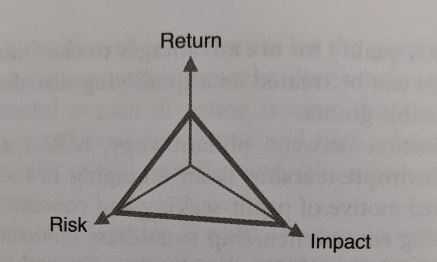

The third step is to develop an impact investment policy. This will specify the method by which the ESG related targets will be included in the portfolio construction and investment management processes. The CAIA textbook shows a chart with three axes : Return, Risk, and Impact. The closer any point on the graph is to each of the labels, the more that label represents a high priority. The shaded area represents target combinations of risk, return and impact.

Generate and Evaluate Deal Flow

The fourth step is to generate and evaluate deal flow. Target graphs can be used to depict the valuation of individual assets. ESG ratings and materiality analysis are used in the step to asset hotel likely impact of various investments

Portfolio Construction and Management

Portfolio construction and management is the fifth and final step. Top down asset allocation decisions should reflect the fact that different asset classes have different ESG opportunities, in addition to different risk and return tradeoffs. One example is timber, which is low risk, low return, and will have an impact factor that depends a lot on the specific sustainable practices used. The portfolio construction starts with optimizing the top down tradeoff, between the goals of hi return, low risk, and high impact, and the opportunities available in each asset class. Finally there is a bottom aspect part where the firm selects and weighs individual investment opportunities, analyzing the tradeoffs between risk, return, and impact.