NT BDC Launch Trends Highlight Two Ways the Market Has Changed

In the mid 2010s, it looked like the entire non-traded BDC industry was on the verge of extinction. Several major funds closed, and overall assets declined steadily between 2017 and 2020. Yet beneath the surface, the beginnings of a new boom boom were already building.

The new boom in the NT BDC market is part of the broader popularity of private credit strategies within the retail channel. Recent NT BDC Launch trends reflect two major changes in the market. First of all, Private NT BDCs are far greater in number, even though the bulk of assets remains in Public funds. Second, most new NT BDCs are Evergreen vehicles.

Rise of Private NT BDCs

During the prior cycle, most NT BDCs came to market through public offerings. However, starting in 2020, several new NT BDCs came to marke exclusively through private placement offerings. In 2024, 20 private NT BDCs launched, while only one public NT BDC launched.

This chart shows NT BDC launch trends by type of offering:

There is one important caveat to “rise of private NT BDCs narrative.” Although Private NT BDCs are greater in number, most AUM in the sector is concentrated in a small number of publicly offered funds. Blackstone Private Credit Fund, with $65 billion in total assets and $36 billion of net assets accounts for 25% of total NT BDC assets, and 26% of NT BDC net assets. The second largest NT BDC is Blue Owl Credit Income Corp, with $26 billion in total assets and $13 billion in net assets.

More Evergreen NT BDCs

Traditionally, most NT BDCs came to market with specific plans to list, merge, or liquidate within a set number of years. However, in the mid 2010s publicly traded BDCs suffered from major NAV discounts, making it difficult for NT BDCs to list.

Starting in 2022 Perpetual Life, or Evergreen NT BDCs started coming to market. These new funds launch with the specific intention of existing as a non-traded vehicle in perpetuity. In 2024, there were 15 Evergreen NT BDCs that launched, compared to 6 Finite life funds. Meanwhile, by design, Finite Life BDCs leave the market, leaving the Evergreen structures with a much larger market share. Note that there has been a broader industry shift towards more evergreen fund structures. Substantially all interval funds are evergreen vehicles.

A Note on Classification

Publicly offered NT BDCs must wait for the SEC to declare their prospectus effective before raising capital. The official launch date in our dataset for Public NT BDCs is the day that Form EFFECT is released on EDGAR, indicating that the SEC has declared their prospectus effective.

In contrast, Private NT BDCs rely on a registration exemption. They will generally file Form D immediately before or after they start raising capital. They will also disclose ongoing capital raising progress through Form 8-K filings. The official launch date for Private NT BDCs in our dataset is the date they file Form N-54A with the SEC. This is the form that funds file to notify the SEC of their intention to be treated as a BDC. All NT BDCs must file Form N-54A, and the public NT BDCs often file the N-54A on the same day as Form Effect.

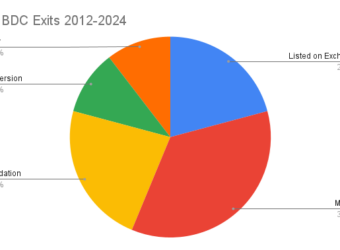

NT BDC Market Exits

Since 2012, 48 NT BDCs have gone full cycle. The most common reason for exiting the NT BDC market is merger. This includes both affiliate and non-affiilate M&A activity. The second most common reason is Liquidation. Listings are the third most common exit path, accounting for 21% of the total.

Additional Tools and Resources

To access the industry’s most complete dataset covering NT BDCS, NT REITs and Opcos, sign up for Alternative.Investments Pro. Its an essential resource for anyone involved in product development, investment research, or due diligence within the retail alts space.

For comprehensive competive intelligence on the unlisted CEF industry, sign up for a Premium Plus Membership.

We also have a lot of data available for free:

- Complete list of all active interval funds

- Complete list of all active tender offer funds

- Non-traded REITs

- Non-traded BDCs

- Conglomerates, Opcos, and other alternative funds.

Interested in advertising on or Alternative.Investments or Interval Fund Tracker? email jacob@intervalfundtracker.com to learn about partnership opportunities.

Holding alternative investment funds that you need to exit quickly? We also have liquidity solutions for unlisted securities