Retail Access to Private Markets: What the SEC’s IAC Report Means for Registered Funds and Asset Managers

In September 2025, the SEC’s Investor Advisory Committee (IAC) released its recommendations on “Retail Investor Access to Private Market Assets.” While not binding, the report reflects growing regulatory momentum toward expanding ordinary investors’ ability to participate in private equity, private credit, venture capital, and real estate.

For asset managers, the message is clear: the democratization of private markets is no longer a distant possibility but an active policy direction. The IAC’s proposals, combined with recent SEC staff guidance, point to both significant growth opportunities and new governance, valuation, and liquidity challenges.

Registered Funds as the Gateway

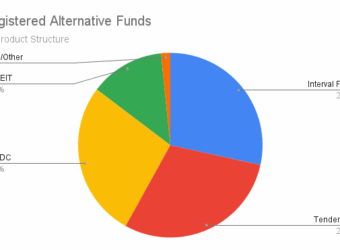

The IAC’s central recommendation is that retail investors should access private markets primarily through registered investment funds—interval funds, tender offer funds, and other closed-end structures regulated under the Investment Company Act of 1940. This gives asset managers a blueprint: if you want to reach the mass-affluent investor, do so within a framework that provides familiar investor protections—independent boards, audited financials, liquidity rules, and robust disclosure.

For managers who have already invested in interval or tender-offer platforms, this validates their strategic bet. For others, the pressure is building to consider how their flagship private strategies could be adapted into retail-facing vehicles.

Thematic Shifts Managers Must Prepare For

- Valuation Scrutiny

The IAC calls for clearer, standardized disclosures around valuation. Asset managers will need more transparent policies, potentially involving third-party validation and enhanced board oversight. This is not just a compliance issue—investors and advisors will increasingly compare funds on how credible their NAVs appear. - Liquidity Expectations

The committee even suggested amending Rule 23c-3 to allow monthly redemptions for interval funds. If implemented, that could set a new benchmark for retail-facing private market vehicles. Managers will need robust liquidity-management tools and diversified portfolio construction to handle redemptions without creating fire-sale risk. - Fund Structures and Share Classes

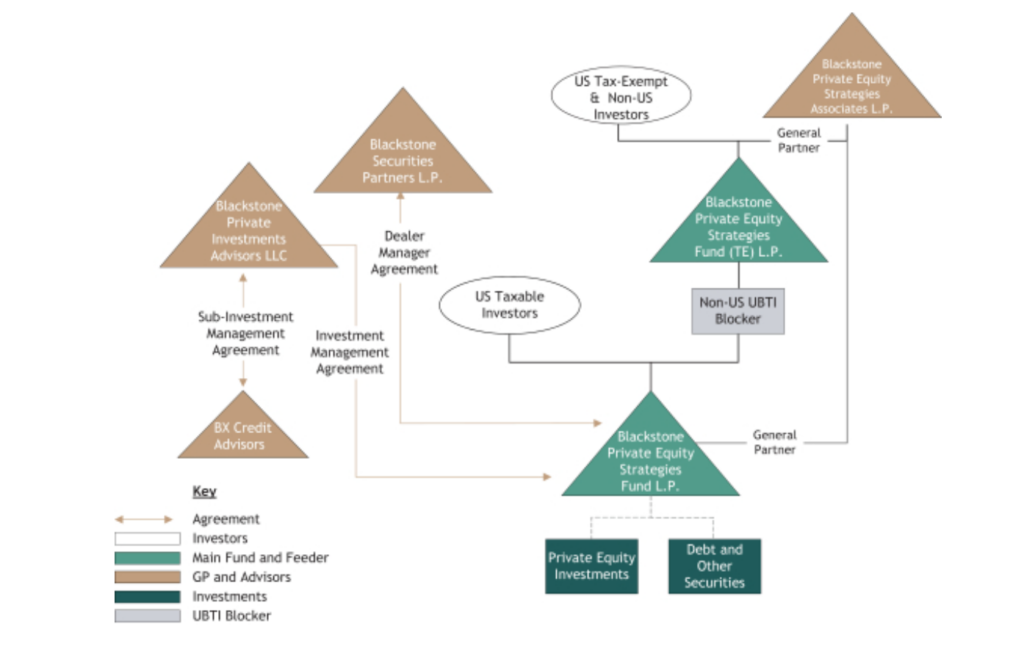

Recommendations to codify multi-class share structures and permit series closed-end funds could lower operational costs, accelerate time to market, and allow managers to scale across multiple retail strategies. - Expanded Co-Investment Opportunities

By codifying co-investment relief, the IAC seeks to let registered funds participate alongside affiliated private funds. This could deepen deal flow for retail vehicles—but it also magnifies the need for strong conflict-management policies around allocation and pricing. - Enhanced Disclosure and Distribution Oversight

Layered, standardized disclosure will likely become the norm, coupled with stronger regulatory expectations for advisors under Regulation Best Interest. Managers should expect to invest more in plain-language marketing and advisor training materials to explain complex, illiquid products.

Opportunities and Risks

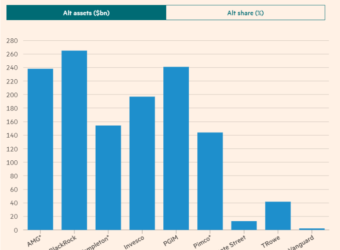

The opportunities are substantial. Asset managers can tap into a vastly larger pool of capital as retail investors allocate to private markets through retirement accounts and brokerage platforms. Firms that master registered-fund structures may find themselves with a durable competitive advantage.

But the risks are equally real. Liquidity mismatches could damage reputations if investors feel “trapped” in funds during downturns. Valuation opacity could invite scrutiny, particularly if funds are slow to mark down private holdings. Compliance costs will rise, and smaller managers may struggle to compete with global firms that can absorb the overhead.

There is also political risk. Some SEC commissioners, most notably Caroline Crenshaw, have warned about systemic dangers if retail investors pour into illiquid markets. That dissent means asset managers should not assume the regulatory trajectory is entirely linear.

The Bottom Line

For asset managers, the IAC report is less about specific rule changes and more about strategic positioning. The regulatory environment is clearly tilting toward wider retail participation in private markets—but only within guardrails that emphasize transparency, governance, and investor protection.

The next decade may see the emergence of a two-track market: one in which institutional funds continue to dominate long-lockup strategies, and another in which registered retail vehicles channel trillions of dollars into private credit, equity, and real assets.

For managers willing to adapt, this could represent one of the largest growth opportunities since the rise of ETFs. But success will depend on marrying the innovation of private markets with the rigor of public-market investor protections.