How Funds of Hedge Funds Add Value

Funds of hedge funds have no shortage of critics. The common concern that analysts have about funds of funds is the extra layer of fees. Hedge funds already charge high fees. Adding a funds of funds manager on top increases the return hurdle necessary to beat the market. Some people are skeptical that funds of hedge funds add any value when compared to a randomly selected group of hedge funds. There is a wide dispersion in performance among hedge funds. Do funds of funds help you gain access to the best opportunities?

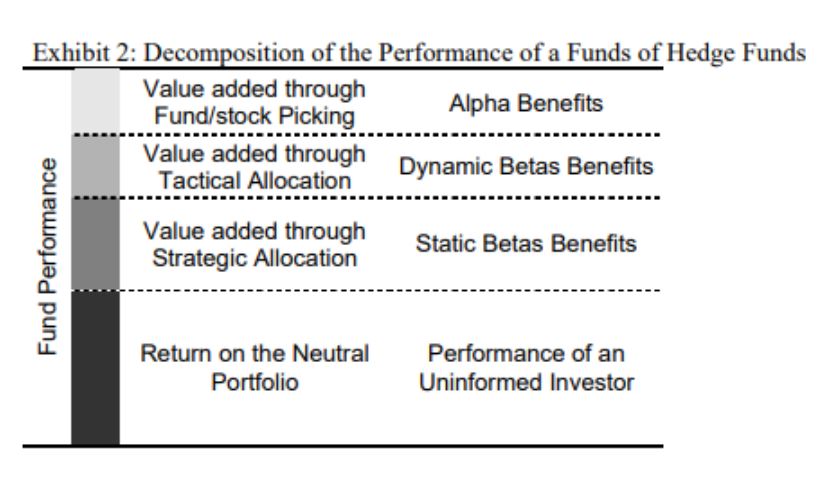

Researchers have studied this very question and identified three different ways that funds of funds managers can add value. First strategic allocation can provide static beta benefits. Second, tactical allocation can add dynamic beta benefits. Finally, fund selection can add alpha to a hedge fund portfolio.

This graphic demonstrates how Strategic Asset Allocation, Tactical Asset Allocation,and Fund Selection add value beyond a random selection of hedge funds:

Let’s examine each of these value add approaches individually.

Strategic Asset Allocation

Strategic asset allocation of a fund of hedge funds reflects the long-term bets made by the

portfolio manager. Strategic asset allocation is a crucial step in the investment process. It adds the most value over the long term. Perhaps more importantly, it also builds resilience in the portfolio that will pay off when investors need it most. With proper strategic asset allocation, a hedge fund investor can get through a downturn while avoiding large losses.

Research from the EDHEC Risk Institute found statistically significant evidence of value add from strategic asset allocation under stressed market conditions from 2007-2009. The top 7.77% of hedge funds were able to add 3.50% annually.

Tactical Asset Allocation

While fund managers only rarely make strategic asset allocation shifts, they might frequently make tactical allocation shifts. Unfortunately, there is little evidence that most funds of hedge funds managers add value through tactical asset allocation. There are exceptions, however. Some managers are able to identify short term trends, and access the funds most capable of exploiting those trends.

Fund Selection

One barrier to hedge fund investing for firms with smaller staffs is the due diligence requirements. Consequently, they might turn to a fund of funds manager to help with due diligence on individual hedge funds. Indeed, fund selection is where its possible to truly add alpha.

However, Alternative Investments: An Allocators Approach notes that fund selection is a “double edged sword”. In normal markets, ~93% of fund of hedge funds had an annual positive outperformance of 3.9% over the neutral portfolio. However in stressed market conditions, only 48.4% of funds of hedge funds added value of 4.18% annually.

So ultimately, an allocator can benefit from a funds of funds approach. However, they need to make sure to find the right funds of hedge funds manager.

See also:

DO FUNDS OF HEDGE FUNDS REALLY ADD VALUE: A POST-CRISIS ANALYSIS

Do funds of hedge funds add value?

Fund of Fund Managers Can Add Value

One way investors can access funds of funds in a transparent, tax friendly vehicle, is through unlisted closed end funds. To learn more about unlisted closed end funds pursuing hedge fund strategies, visit Tender Offer Funds.