Morgan Creek Global Equity Long/Short Fund Liquidation

Morgan Creek Global Equity Long/Short Fund launched in 2011. It is an unlisted closed end fund(tender offer fund) that invests in a diversified portfolio of hedge funds and other private funds, mainly following long/short equity strategies, including both US and foreign stocks. They invested in many of the largest brand name hedge fund franchises including Tiger Global.

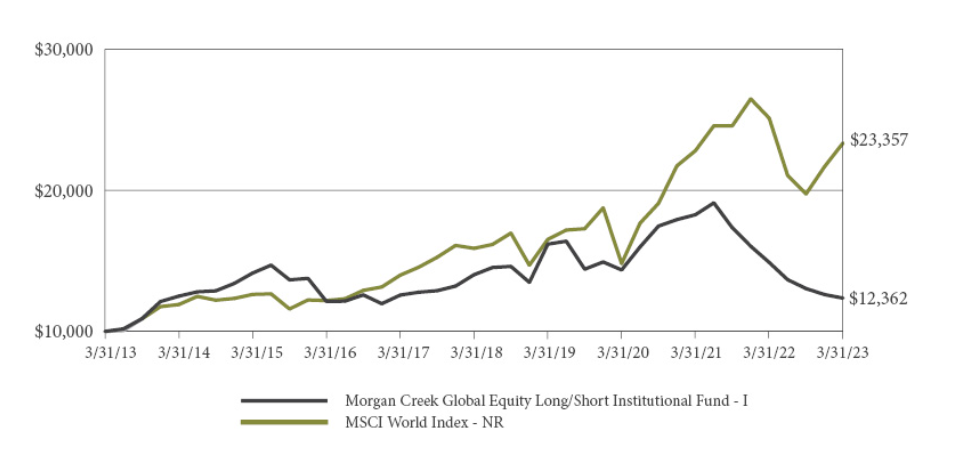

Unfortunately Morgan Creek had a difficult time in the mid to late 2010s. Its performance has lagged the MSCI World Index.

Morgan Creek Liquidation Plan

It faced a wave of redemption requests, making the funds operations uneconomical. Ultimately it decided to liquidate:

The asset size of the Fund had decreased to a level where the fixed operating costs of continuing to manage the Fund were difficult to justify, and in light of poor recent performance at that time, we did not have confidence in our ability to raise sufficient new funds to reduce the expense ratio in a timely manner. The Fund officially commenced its liquidation after the 2022 fiscal year audit was complete and the first distribution was paid in the middle of August.

Source: 2022 Annual Report

Morgan Creek has already sold its most liquid assets, and made several significant distributions. In August 2022, they paid out approximately 48% of the fund’s June 30 NAV. During the second quarter of 2023, they paid out another 10%. The remaining portfolio consists of the most illiquid, difficult to sell assets.

The remaining portfolio consists of two managers, private holdings, and a cash balance to cover the Fund’s projected operating expenses. For the two remaining managers, Teng Yue provides 15% liquidity per quarter and Tiger Global 25% per year. We expect the final tranche of our full redemption in Teng Yue to process on March 31, 2024 and the final tranche of our full redemption in Tiger Global on December 31, 2024. The private holdings have no pre-determined liquidity schedule and we continue to evaluate all available liquidity options in the context of value maximization.

Source: 2022 Annual ReportFor the remaining assets, valuation is also a concern. Tiger Global made a lot of extremely aggressive investments in tech startups at extremely high valuations. In recent months they have been in the headlines as they struggle to find liquidity. It seems there is a high risk Tiger Global’s portfolio will be written down further, and the ultimate payout to investors will be far lower than the stated NAV. That will reduce the payout to investors in Morgan Creek Global Equity Long/Short Fund. At the same time, investors have limited visibility into the valuation methods of the other remaining portfolio holdings.

What if they are unable to sell the remaining assets? The plan of liquidation permits the Fund to establish a liquidating trust, and transfer remaining unsold assets into it. Fund investors would then be left holding liquidating trust units for an indefinite period of time.

No Exit?

As investors wait for Morgan Creek to liquidate the rest of the portfolio, they have few ways to get liquidity. The shares are not traded on any exchange. Morgan Creek had typically provided investors with liquidity through quarterly share repurchases, but they suspended all share repurchases since April 2022.

Investors who don’t want the uncertainty of the liquidation can try to sell their shares in a private transaction. Alternative Liquidity Capital recently launched a tender offer to buy a limited number of shares in Morgan Creek Global Equity Long/Short Fund. Investors with questions about the offer can find more information on Alternative Liquidity’s website.