Why Traditional Asset Managers Need Alternative Investments

The core thesis behind the creation of this site is that alternative investments are no longer alternative- they are an essential part of any portfolio. The Financial Times recently published an article highlighting a key trend that supports this thesis:

Fund houses buy up ‘alts specialists’

The $100 billion Club

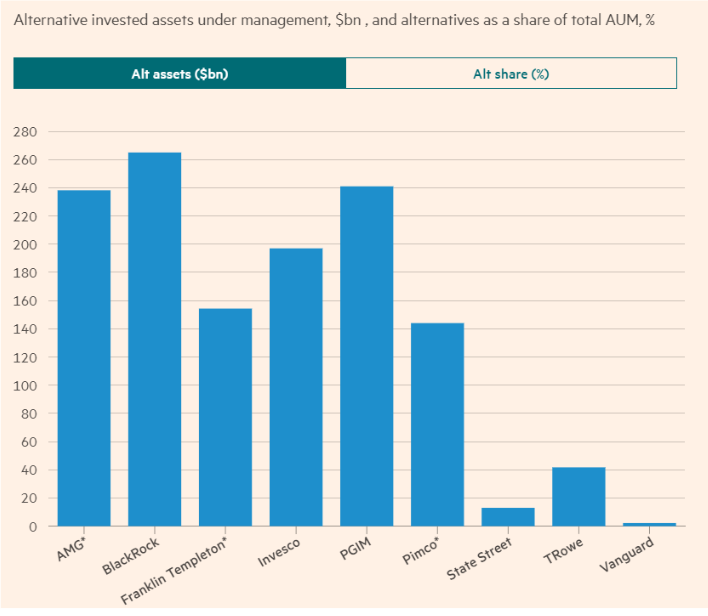

According to the FT, more than a dozen fund groups known for mutual funds and ETFs reported at least a $100billion in alternative assets at the end of 2021. These include firms such as BlackRock, Franklin Templeton Pimco, and Invesco.

This chart shows the amount of alt assets at a few major firms.

The original article has an interactive version of this chart.

There are basically two ways mutual fund and ETF focused asset managers can expand into alternatives- build it or buy it. However, the latter method- asset manager M&A, is what seems to be making the biggest splash in the industry. For example, AllianceBernstein announced plans to purchase CarVal Investors, building its alternatives business to nearly $50 billion. Franklin Templeton is buying Lexington Partners, increasing its alternative asset AUM to $200 billion.

Why traditional asset managers need alternative investments

Why are traditional asset managers so keen to buy alternative asset managers? The key reason is investor demand. Institutional investors have all been increasing their allocation to private lending, private equity real estate, infrastructure, and private equity in recent years. A recent survey found that 86% of institutional limited partners intended to invest the same or more money in private capital in coming years.

So the institutional channel is big and growing. But the real story is the “mass affluent” retail investor demand for alternative funds:

The fund mangers also hope to capitalise on an expected wave of interest from wealthy retail clients looking for stable long-term returns at a time when bonds and equities have been volatile. Some envy the success of alternative managers in introducing products for the very rich, such as real estate and credit funds launched by BlackStone, the worlds largest private equity group.

Industry Impact

Most people don’t think of firms like BlackRock, Franklin Templeton, Pimco, or Invesco as alternative asset managers, yet they are starting to shift their focus. BlackRock CEO Larry Fink ‘s annual letter to shareholders mentioned that plans to accelerate growth in private markets were central to the group’s strategy. The entrance of large traditional fund managers into the retail alternative channel is going to dramatically alter the shape of the industry. They will open up new sales channels for alternative products, while also raising the bar in terms of quality and transparency.

In fact, traditional asset managers have already started to make a major impact on key niches of the alternative fund management industry, such as non-traded REITs and interval funds. The Blackrock Credit Strategies Fund is a closed end interval fund that launched in 2018. It now has $428.2 million in assets. When Franklin Templeton bought out Benefit Street Partners, they took over management of a non-traded REIT, now known as the Franklin BSP Real Estate Trust . The Invesco Senior Loan Fund is one of the longest running interval funds. Research at Interval Fund Tracker highlighted how well it weathered the global financial crisis of 2008-2009. The Invesco Dynamic Opportunities fund was previously a traditional exchange traded closed end fund, but it converted to an interval fund while staying on the exchange.