Blackstone Private Equity Strategies Fund Revives Launch Plans

Redemption overload at Blackstone’s flagship non-traded REIT cast a pall over the whole retail alternative sector for several months. Blackstone had to delay the launch of Blackstone Private Equity Strategies Fund(BXPE), a publicly registered vehicle designed to bring traditional private equity to a wider audience of investors.

Yet the launch plans are back on now, as the Financial Times has reported. Blackstone will begin taking subscriptions from investors in Q4 of this year, and the fund will officially launch in January 2024.

A closer look at Blackstone Private Equity Strategies Fund

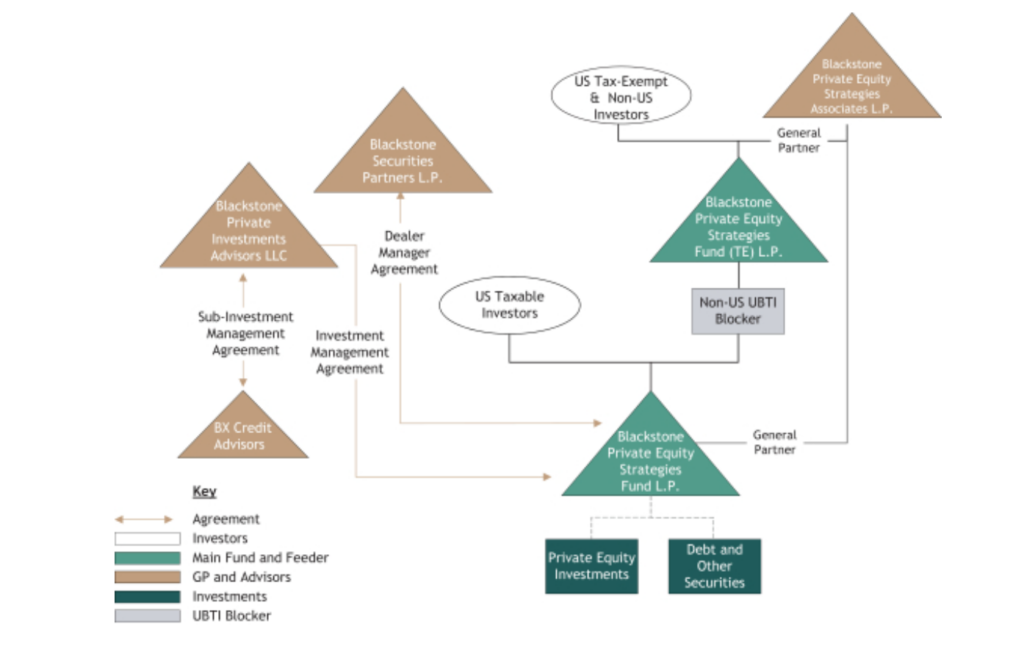

According to public SEC filings, BXPE will conduct a private offering to investors that qualify as both accredited investors and qualified purchasers. It is a perpetual life strategy with monthly fully funded subscriptions and periodic repurchase offers. Theoretically this structure will be optimal for investors looking to include a targeted percentage of private equity exposure as part of an overall allocation strategy or model portfolio.

BXPE will receive a management fee of 1.25% of NAV, plus a performance allocation of 12.5% over a 5.0% hurdle.

BXPE also plans to offer to repurchase 5% of units per quarter, although these repurchase are at the discretion of the GP. This is a similar setup to the NT REITs and BDCs, where repurchases are at the discretion of the board.

BXPE will file quarterly reports on form 10-Q, and annual reports on Form 10-K. This will provide more transparency than typical for a private equity fund, although the underlying portfolio holdings will still be private.

Here is the fund’s strategy:

Implications of BXPE’s Revival

So Blackstone Private Equity Strategies Fund is back on. Does this mean the redemption storm has passed? No, there will always be liquidity mismatches in investment funds that hold illiquid assets but have an investor base expecting more frequent liquidity. However, if advisors manage client expectations, and make realistic liquidity plans, then alternatives will still play a valuable role in retail investor portfolios. Blackstone’s plan to move forward with BXPE is a bright sign for this sector.