Four Structuring Options for Retail Cryptocurrency Funds

Blockchain and cryptocurrency are major growth areas. According to Northern Trust:

According to Fidelity, one-third of institutional investors now hold digital assets such as Bitcoin,3 and 47% see digital assets as having a place in their portfolios.4 Given this data, it’s clear that their acceptance of cryptocurrency has come a long way in the last decade. As they embrace the idea of investing in cryptocurrency, pure-play crypto hedge funds and hedge funds who offer crypto funds are sure to see greater demand – and potentially already have.

The total AuM of global crypto hedge funds roughly doubled from 2018 to 2019.5 Family offices are leading the way in this movement, making up 48% of crypto hedge fund investors, while high net worth individuals make up 42%, indicating untapped opportunity to bring other classes of institutional investors – such as pension plans and foundations and endowments – into the fold.

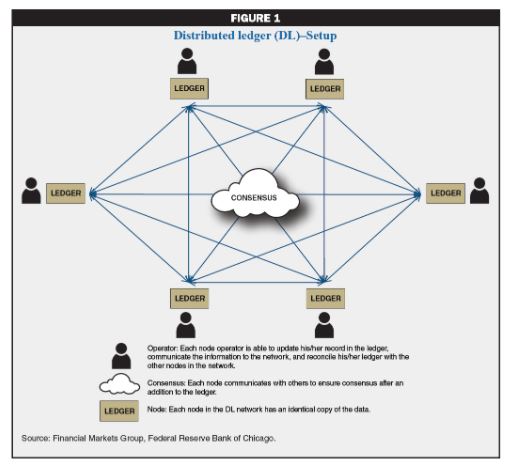

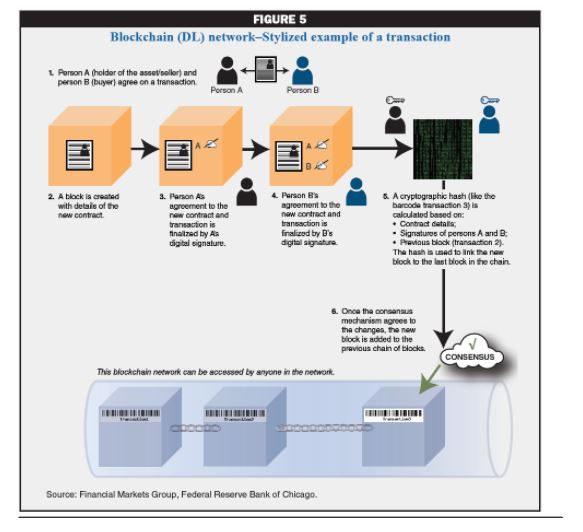

In a previous post, we covered the Key Benefits and Challenges of Blockchain Technology. In this post we’re going to cover fund structuring options for asset managers focused on retail investors. A 2018 article in The Review of Securities and Commodities Regulation is a great place to start.

The caveat to this post is that regulatory issues surrounding blockchain, digital assets, an cryptocurrency are fast moving. Therefore, before getting ready to launch a fund, you should look for regulatory updates, and engage with appropriate legal counsel. Nonetheless Here is a quick overview of the options that you have.

Open End Fund

There are a still a number of outstanding issues that the SEC believes need to be addressed before anyone can launch an open end crypto fund (ie a mutual fund or an ETF). However there are many commentators who believe that the SEC will change its views in the near future. Moreover, many other countries including Canada, Sweden, and Switzerland, have already approved cryptocurrency ETFs.

Closed End Fund

In the US, closed end funds face many of the same hurdles that open end funds face when getting approved for cryptocurrency investment. Quoting from the article:

In light of the SEC’s concerns regarding exchange trading, a cryptocurrency fund, including a Closed-End Fund, may consider foregoing the listing and trading of its shares on an exchange. As an alternative, a Closed-End Fund could provide periodic liquidity to shareholders either by making periodic tender offers pursuant to Exchange Act tender offer rules (“Tender Offer Fund”) or could elect to operate as an interval fund under Investment Company Act Rule 23c-3 (“Interval Fund”). Importantly, although generally prohibited under Regulation M of the Exchange Act, a Closed-End Fund – whether a Tender Offer Fund or an Interval Fund – is permitted to continuously offer and redeem its shares simultaneously.13 Without this permission, a Closed-End Fund would either not be able to take in new capital or would not be able to offer shareholders liquidity.

Separate from the legal issues, closed end funds have a lot of economic advantages over open end funds for cryptocurrency investments. Check out: Closed End Funds Are A Better Solution For Digital Assets

33 Act/ETP Structure

Grayscale Bitcoin Trust reportedly attempted to register as an ETP, but was unable to do so. However, it was able to conduct an offering under a registration exemption under Rule 506(c) of Regulation D promulgated under the Securities Act of 1933. This process has proven much easier than using a 40 act structure(ie an open end fund or a closed end fund). However 33 Act companies often don’t have the same level of investment protection.

Commodity Pool

Given the growth of the cryptocurrency derivatives market, its likely some fund sponsors will come up with commodity pool structures that offer cryptocurrency exposure. These funds would be required to register with the CFTC as commodity pool operators, but would avoid some SEC complications.

Key Considerations Regardless of Structure

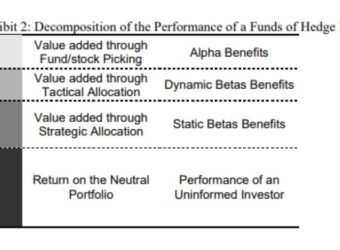

Regardless of fund structure, there are several issues a firm needs to concern. A key challenging is to find the right service providers to be partners in the strategy. Northern Trust, in a recent post suggested there should be three key considerations: (1) Previous experience servicing crypto strategies (2) Assistance with investor transparency and (3) Risk averse custody optoins.