Invesco Launches Non-Traded REIT

Invesco has entered the non-traded REIT space with the launch of a new fund: the Invesco Real Estate Income Trust, Inc. This fund filed an initial draft registration statement on December 31, 2019, and conducted a private offering in 2020. On March 31, 2021, it filed a registration statement for a public offering, which the SEC declared effective on May 14, 2021.

Investment Strategy

The Fund’s investment objective is current income and capital appreciation. It will invest primarily in stabilized, income-oriented commercial real estate in the United States. Invesco Real EState Income Trust will invest in a broad range of property types including multifamily, industrial, retail, office, healthcare, student housing, hotels, senior living, data centers and self-storage. It will use the FTSE EPRA/Nareit Developed Index as its benchmark.

The fund has a mandate that allows it to invest globally. In order to fund liquidity for distribution payments, and the repurchase plan, it may also hold more liquid real estate related securities.

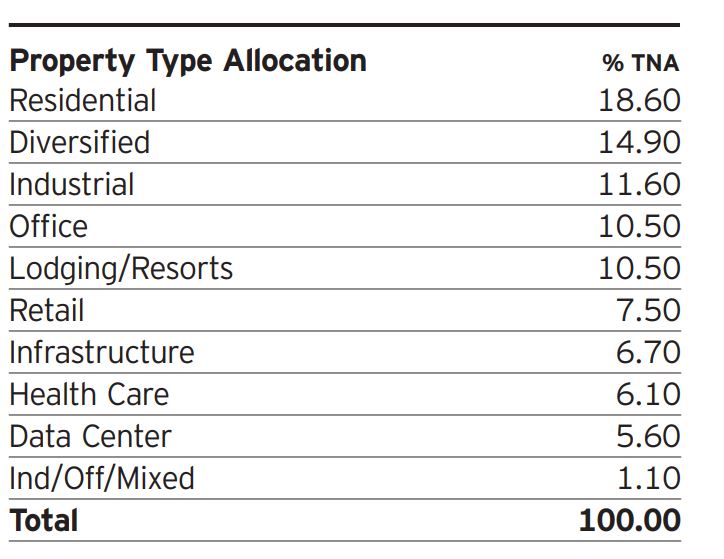

Since the fund conducted a private offering, it already has $31 million in net assets in the portfolio. The following table summarizes its property type allocation.

Share Classes

According to its prospectus, Invesco Real Estate Income Trust is raising up to $3 billion, and will have a total of 5 share classes. Class T, Class S, and Class D shares all have varying levels of up front selling commissions. Class I and Class E shares however, will not have any upfront selling costs. The minimum initial investment for Class T, Class S, Class D and Class E shares is $2,500. Class I shares are intended for institutional investors, and have a $1,000,000 minimum initial investment.

The fund will pay an annual management fee equal to 1.0% of NAV. Additionally, the Adviser will be entitled to a performance allocation of 12.5% over a 6.0% hurdle, with a high water mark, and catch up feature. The fund will not charge any acquisition, disposition, or financing coordination fees.

More details on Invesco Real Estate Income Trust’s strategy is available to premium subscribers. Click here to learn more about data and tools available to premium subscribers.

About Invesco

Invesco is a global investment manager with $1.2 trillion in assets under management. Headquartered in Atlanta, Georgia, it has more than 8000 employees branch offices in 20 countries. Invesco’s common stock also trades on the New York Stock Exchange under the ticker symbol “IVZ”. Invesco’s funds have a diverse investor base. According to its most recent annual report, approximately 70% of IVZ’s AUM is from retail investors, and 30% is from institutional investors. Invesco Real Estate buys and sells approximately $7.4 billion in real estate globally, in addition to real estate related securities.

Although This is Invesco’s first non-traded REIT, it has extensive experience marketing alternative investment products in the retail channel. Notably, Invesco has one of the longest running interval funds. Additionally, it is in the process of converting one of its closed end funds into an interval fund.