Five Components of an Asset Allocation Framework

Traditional portfolio management techniques such as mean-variance optimization or risk parity don’t capture the reality faced by an allocator building a portfolio that includes alternative investments. These traditional methods focus on return variability and drawdowns, while treating liquidity risk as a secondary considerations.

Yet in reality, liquidity risk is of critical importance. In fact, while return variability and drawdowns are generally transitory, liquidity risk can cause permanent damage to a portfolio.

There is a tradeoff between performance and liquidity in asset allocation. At one extreme, holding illiquid but high performing assets might give investors little room to maneuver and meet liquidity demands. In a downside scenario, these illiquid assets would ultimately hurt performance because the allocator would need to sell them prematurely at a discount to meet cash needs. At the other extreme, an all liquid portfolio might not generate the high enough returns. Handling this tradeoff is the central challenge for allocators and alternative investment professionals.

GIC and PGIM produced a joint research paper that develops a framework for systematically handling this tradeoff. The paper develops a cash flow-driven asset allocation framework to help investors formulate private asset commitment strategies, determined desired allocations to private funds, and understand how various market scenarios would impact liquidity and performance of their portfolio.

Most research in this area generally falls into two buckets: cash flow prediction models, and private asset commitment strategies. GIC and PGIM integrate these strategies.

Visualizing the role of private investments

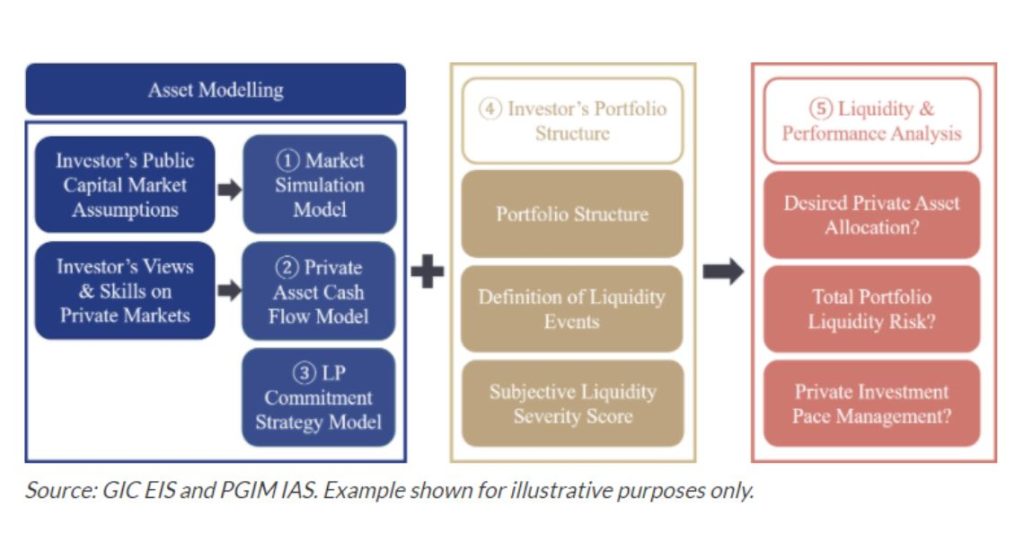

This flow chart explains the framework for allocating to private investments.

This asset allocation framework has five major components

- Market simulation model

- Private Asset Cash Flow Model

- LP Commitment Strategy Model

- Investor’s Portfolio Structure

- Liquidity and Performance Analysis

The first three steps involve asset modelling. To begin with the researchers simulated the risk and returns of a multi-asset portfolio, including private and public markets. They used the Takahashi and Alexander Model to capture empirical relations between cash flows and public market performance. This framework is also flexible, because it allows investors to input their own public capital market assumptions. This is the first step in the framework- the Market Simulation Model.

The second step, Private Asset Cash Flow Model is closely related to the first step. The framework allows the investors to input their views on private markets and estimate their skills and how they might impact expected returns. A cash flow model that is responsive to underlying capital market conditions allows an allocator to perform stress tests, and tailor liquidity analysis to their estimates for future market scenarios.

The third step involves applying an LP commitment strategy. There are two options. The first is a Cash flow Matching strategy. This involves building a private asset portfolio whose periodic net cash flows are close to zero. So distributions received in each quarter should fund capital calls in the next quarter. A benefit of this strategy is the fact that it can insulate the rest of the portfolio(ie the publicly traded portfolio), from private asset investment activity. This strategy also has limitations In particular it leads to volatile commitment patterns, and since it may result in skipping commitments over multiple periods can make it hard to diversify by fund vintage. Additionally the strategy has no control over how NAV will grow as a percent of overall portfolio. This strategy is also not possible if an allocator is starting a new private capital investment program from scratch, it can only make commitments once distributions have started to arrive.

The second LP commitment strategy is called Target NAV. With this strategy the allocator tries to achieve target NAV as a percentage of the overall portfolio. This strategy divides the private portfolio into three pools of capital- (1) “in the ground” asset also known as the NAV, (2) Committed but uncalled capital, and (3) uncommited capital which is to be allocated to private assets, and distributions from prior commitments that have not yet been committed to new commitments. An advantage of this strategy is that it treats the private allocation of a self contained portfolio. A drawback of this strategy is that it doesn’t balance cash flows, and might require frequent interactions with other parts of the portfolio in order to absorb or free up capital for private market related cash flows.

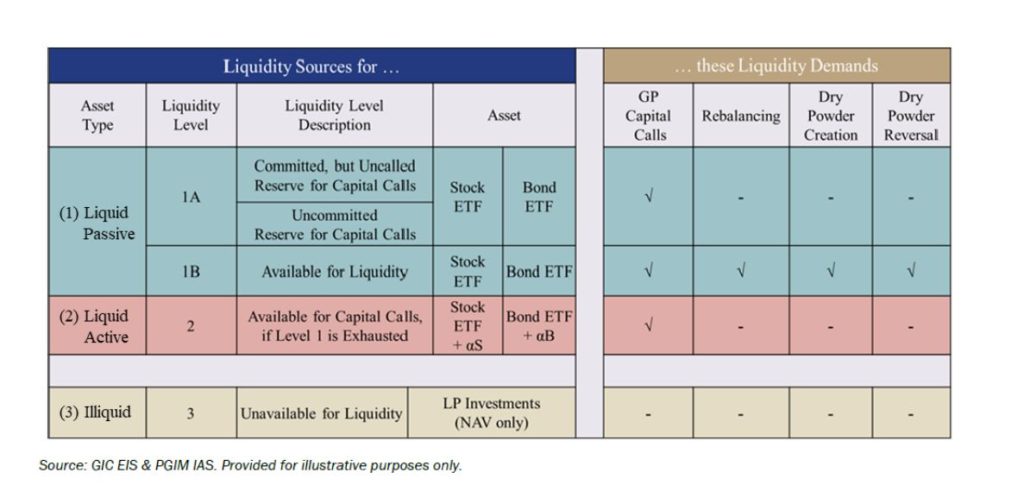

The fourth component of the asset allocation framework is Portfolio Structure. The framework sorts assets by transactability- that is the ease and cost of selling. There are three types of investments, two liquid, and one illiquid. Liquid investments include Liquid passive and liquid active, which are actively managed inpursuit of alpha. . The third category is simply private market investments. This diagram shows how there is a “waterfall” for sourcing liquidity:

A liquidity event occurs whenever an investor needs to move down the waterfall to find lqiudiity. A large liquidity demand could produce a cascade.

The fifth component of the asset allocation framework is Liquidity and Performance analysis.

There are four categories of liquidity demands. Quoting from the paper:

- GP Capital Calls: An obligation that an LP must fulfill based on total initial committed capital amounts, but the timing and amount of each capital call are not under the LP’s control;

- Rebalancing: Shift portfolio allocation between public stocks and public bonds at quarter ends to maintain policy or target weights;

- Dry Powder Creation: A tactical move into higher beta assets (i.e., stocks) during market downturns (i.e., at the end of each month if the public equity market experiences a large drawdown) to provide market support or to take advantage of the market dislocation;

- Dry Powder Reversal: When a market recovery occurs (i.e., when a drawdown is less than -5% following a recovery in the equity market) there is a need to adjust public stocks and bonds back to their initial relative target weights.

The paper also has a case study that illustrates how commitments strategy and portfolio structure interact to determine expected performance. Click here to access the research paper.

In a subsequent post, we’ll follow up with more on portfolio construction with illiquid private assets.