The Reemergence of Non-traded REITs

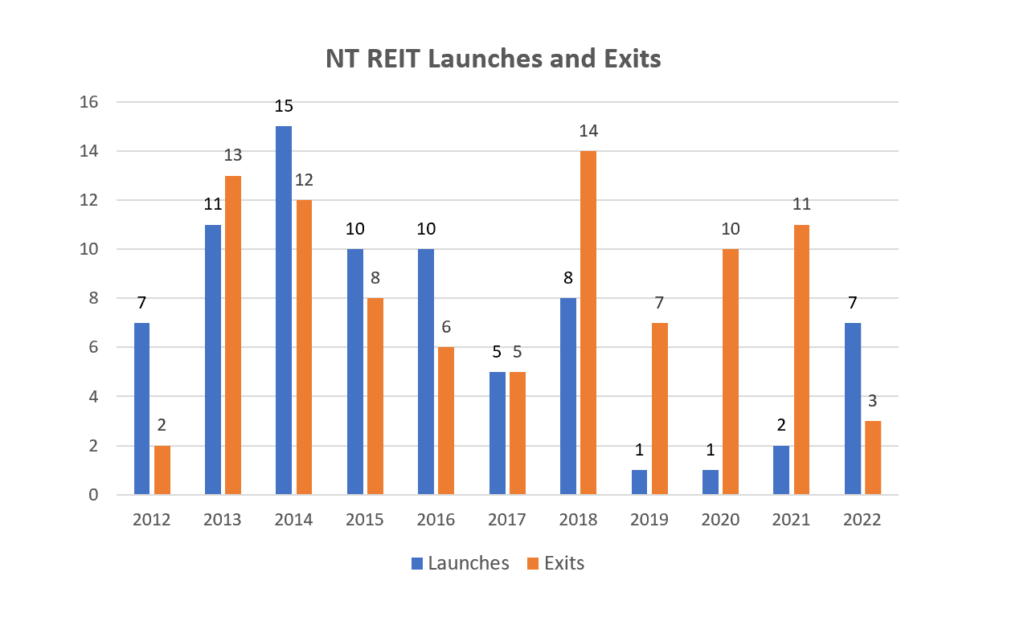

Total non-traded REIT (NT REIT) assets were $232 billion as of the end of 2022Q2, up 76% compared to a year ago. This recent growth has been led by Blackstone, which has come to dominate the sector. Yet several other major asset managers have launched new funds, indicating that the NT REIT is becoming a mainstream institutional product. This year is on track to be first year since 2016 that new NT REIT launches exceed exits.

The NT REIT sector survived three major existential threats in the past decade. First, in 2014, an accounting scandal at the REIT then known as American Realty Capital Properties brought fundraising down across the entire sector. Second, in April 2016 new FINRA 15-02 went into effect, bringing heightened scrutiny on the impact of up front selling costs. Industry participants scrambled to develop share class structures that would blunt the perceived impact, with limited success. Finally, in April 2016, The Department of Labor issued a new fiduciary standard that would have made it nearly impossible to justify high commission products like NT REITs. Although courts overturned this rule, the uncertainty it caused stymied NT REIT fundraising for several years.

Yet NT REITs survived these challenges and reemerged in a new form. In this paper we take a deep dive into the structural changes that have occurred in the NT REIT sector over the past decade. Then we look to the future and consider what the NT REIT sector will become.

Note: This is an excerpt adapted from a The Reemergence of Non-traded BDCs, a research report available to Alternative Investments Pro Members. Click here to sign up and access the full report. Already a member? Click here to login and access the content.

See also:

List of current non-traded REITs with current assets